In the ever-evolving landscape of blockchain and finance, Hyperia stands as a beacon of innovation, dedicated to reshaping the way individuals and enterprises engage with the world of cryptocurrencies. As we introduce this document, we invite you to embark on a journey that demystifies the complexities of crypto analytics, elucidating the power of data-driven insights in making informed decisions.

Within these pages, we unveil the multifaceted nature of our offerings. Hyperia delivers cutting-edge chart analyses that decode market trends and interactive bots that effortlessly integrate into your preferred communication channels. Whether you’re an individual seeking clarity in your financial decisions or a business navigating the complexities of the crypto space, Hyperia’s software solutions are crafted to meet your unique needs.

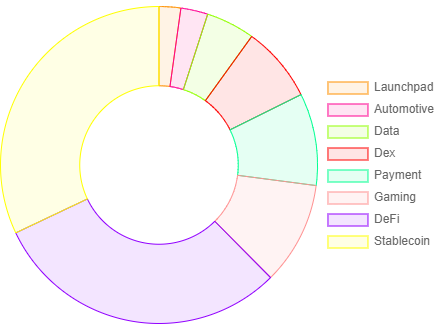

Strategic Insights from Event Distribution Charts

The event distribution charts offer a strategic lens into the blockchain realm, revealing the dynamic distribution of events across sectors like DeFi, Gaming, stablecoins, and more. With each segment holding the key to valuable insights, this data, obtainable from individual or multiple wallets, becomes a powerful tool for informed decision-making.

Transactions Categories

Monthly Transactions Counts by Categories

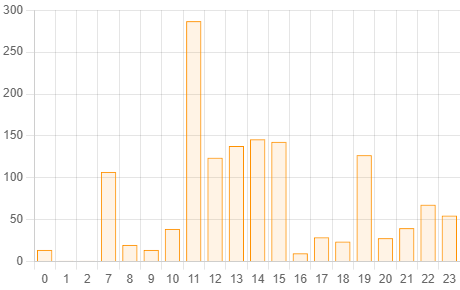

Transaction Frequency Analysis: Optimal Timing Strategies

The integrated graph meticulously portrays the transaction frequency of a specific wallet,

detailing daily and hourly variations over a predefined period. Peaks indicate heightened activity,

while troughs represent periods of lower transactional traffic. This analysis not only underscores

user engagement patterns but also unveils opportune timings for various internal and user-

focused activities.

Transactions per Hours

Transactions per Days

Hyperia Labs and the DeFi ecosystem

This comprehensive analysis not only facilitates a holistic evaluation of investment risks but also provides the foundation for informed risk management protocols and investment thresholds. The GBM model becomes a beacon in strategic financial planning, enabling us to project future liquidity requirements and proactively prepare for diverse market conditions. As we formulate investment strategies, the diverse price scenarios depicted in the analysis guide our adaptive approaches to navigate through various market volatilities.

This data-driven insight is further harnessed in portfolio management, allowing us to tailor investments, adjust asset allocations, and optimize our risk/reward balance for sustained success in the dynamic landscape of financial markets.

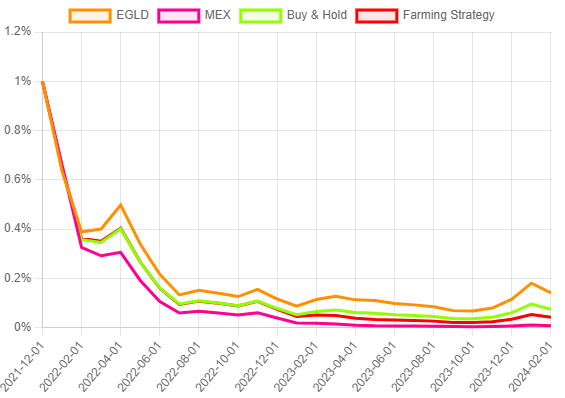

APY Projection

EGLD/MEX

Buy & Hold vs Farming strategy payoff